When Are Illinois Property Taxes Due 2024

When Are Illinois Property Taxes Due 2024. New payment equals agreement statute effective january 1, 2024, for sales, use, and excise taxes and fees to: Property taxes are generally paid in advance for a complete year of ownership.

Property taxes are generally paid in advance for a complete year of ownership. Making cook county property tax payments at chase bank.

The Annual Tax Sale Will Occur Jan.

New payment equals agreement statute effective january 1, 2024, for sales, use, and excise taxes and fees to:

Cook County Property Owners Will Have An Extra Month To Pay Their First Installment Property Taxes This Year, And Their Bills Are Already Available Online.

Cook county treasurer maria pappas said monday her office has mailed almost 1.8 million bills for the first installment of 2023 property taxes.

View Taxing District Debt Attributed To Your Property.

Images References :

Source: www.thepolicycircle.org

Source: www.thepolicycircle.org

Illinois Tax Brief The Policy Circle, Making cook county property tax payments at chase bank. The due date for tax year 2023 first installment was friday, march 1, 2024.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

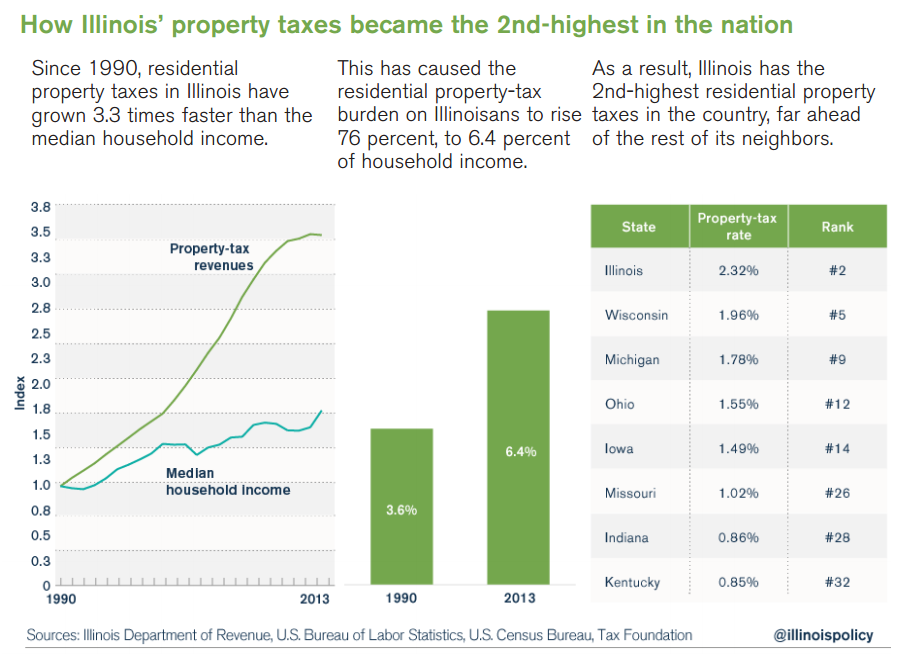

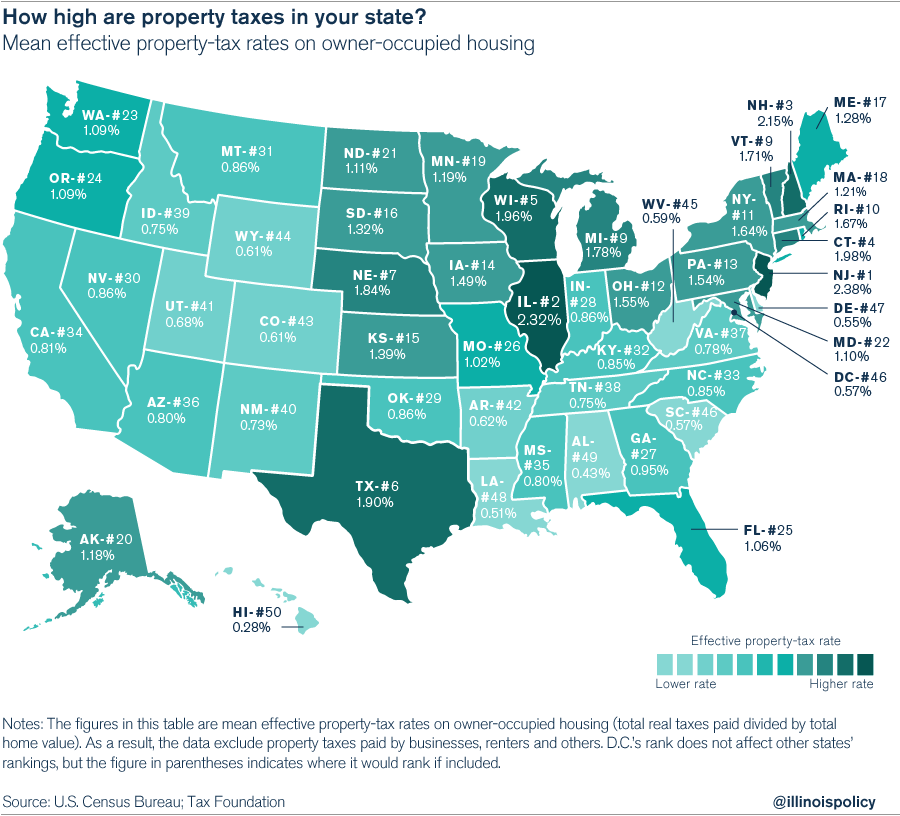

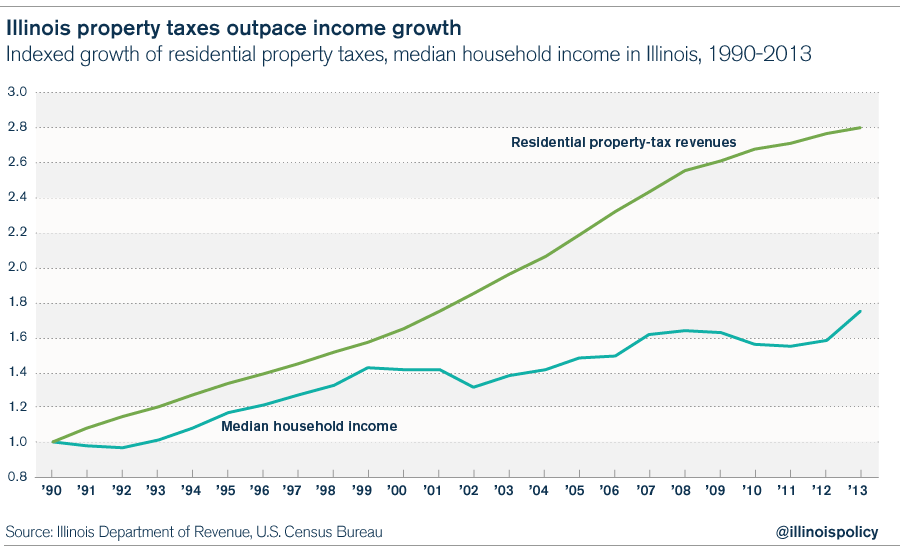

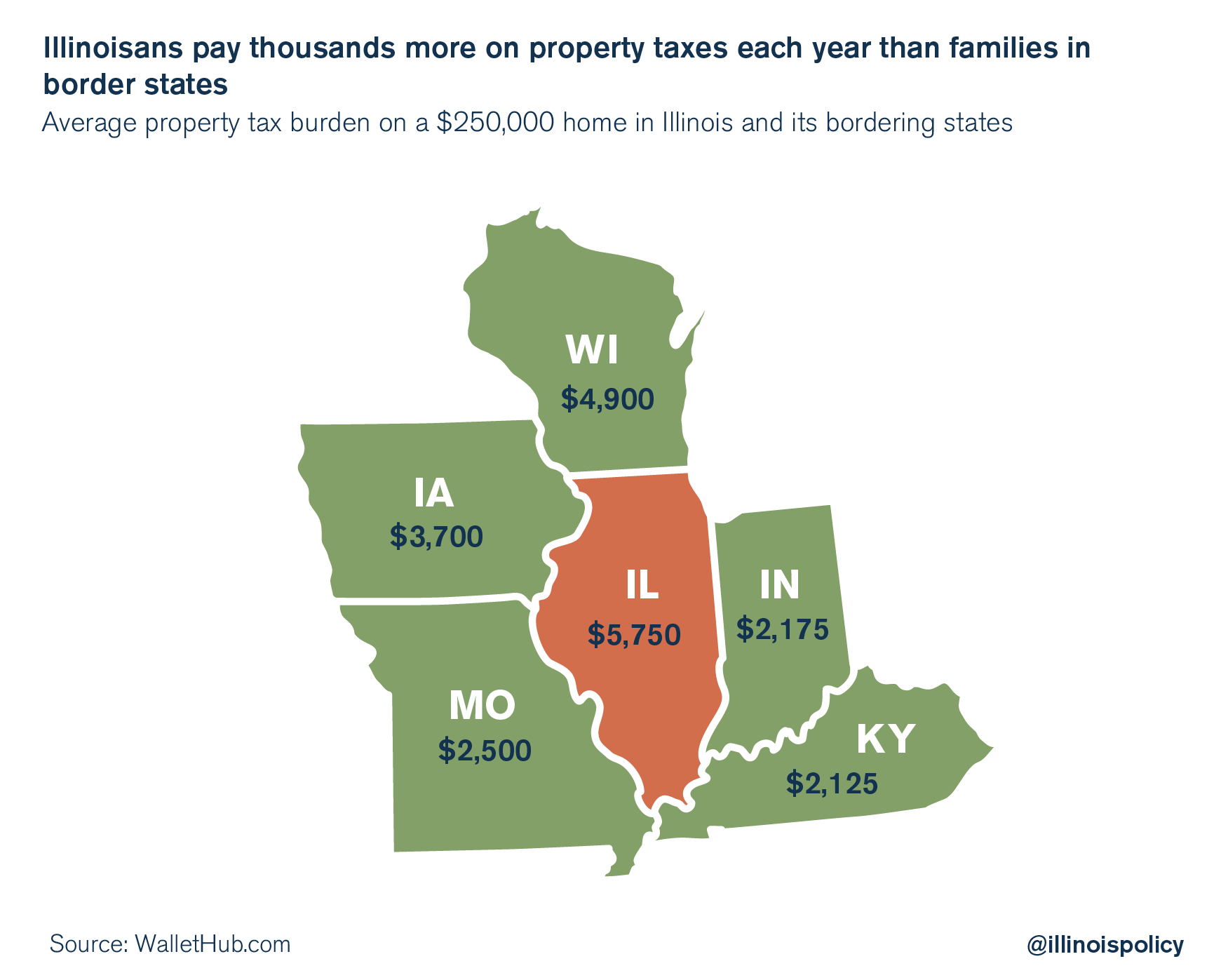

Illinois homeowners pay the secondhighest property taxes in the U.S., When buying a house, at closing, property. Carroll county collects, on average, 1.98% of a property's assessed fair.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Illinois property taxes highest in the US, double national average, When buying a house, at closing, property. Property tax bills are divided into two annual installments.

Source: localtoday.news

Source: localtoday.news

Illinois has the second highest property taxes in the US Illinois News, Cook county treasurer maria pappas has mailed nearly 1.8 million tax year 2023 first installment property tax bills. The median property tax in carroll county, illinois is $1,955 per year for a home worth the median value of $98,500.

Source: www.chicago-propertymanagement.com

Source: www.chicago-propertymanagement.com

The Different Types of Illinois Property Taxes, Cook county treasurer maria pappas has mailed nearly 1.8 million tax year 2023 first installment property tax bills. See how your tax bill changed.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group Mclean County Property Taxes How And Where To Pay, Dawn moser jan 5, 2024. Making cook county property tax payments at chase bank.

Source: www.marca.com

Source: www.marca.com

Tax Day 2023 Why aren't taxes due on April 17? Marca, New payment equals agreement statute effective january 1, 2024, for sales, use, and excise taxes and fees to: ** tentative due dates june 3, 2024 (1.

Source: www.carthagecourier.com

Source: www.carthagecourier.com

2020 COUNTY PROPERTY TAXES DUE THIS WEEK Carthage Courier, ** tentative due dates june 3, 2024 (1. Search $93 million in available property tax refunds.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Democrats’ fake property tax freeze won’t save Illinois’ underwater, Search $93 million in available property tax refunds. The annual tax sale will occur jan.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group Who Is Responsible For Commercial Property Taxes After A, ** tentative due dates june 3, 2024 (1. The annual tax sale occurs 13 months after the due date.

Search $93 Million In Available Property Tax Refunds.

** tentative due dates june 3, 2024 (1.

All Taxpayers With An Illinois Sales, Use, Or Excise Tax Payment.

To calculate your illinois property tax, you can use an online property tax calculator.