What Are The Itemized Deductions For 2024

What Are The Itemized Deductions For 2024. $13,850 for married, filing separately; Itemized deductions help taxpayers lower their annual income tax bill.

For 2023, the standard deduction numbers to beat. Deductions reduce the amount of the income you owe taxes on, thus.

For Taxpayers Who Are Married And Filing Jointly, The Standard Deduction For.

Personal property taxes are different from property taxes.

A Taxpayer Must Choose Either The Itemized Or Standard Deduction.

If your itemized deductions add up to less than your standard deduction, it may not make sense to itemize, because your standard deduction will take off more from.

Itemizing (And Thus, Filing Schedule A) Will Usually Save You Money If The Sum Of Your Itemized Deductions Is Greater Than The.

Images References :

Source: atonce.com

Source: atonce.com

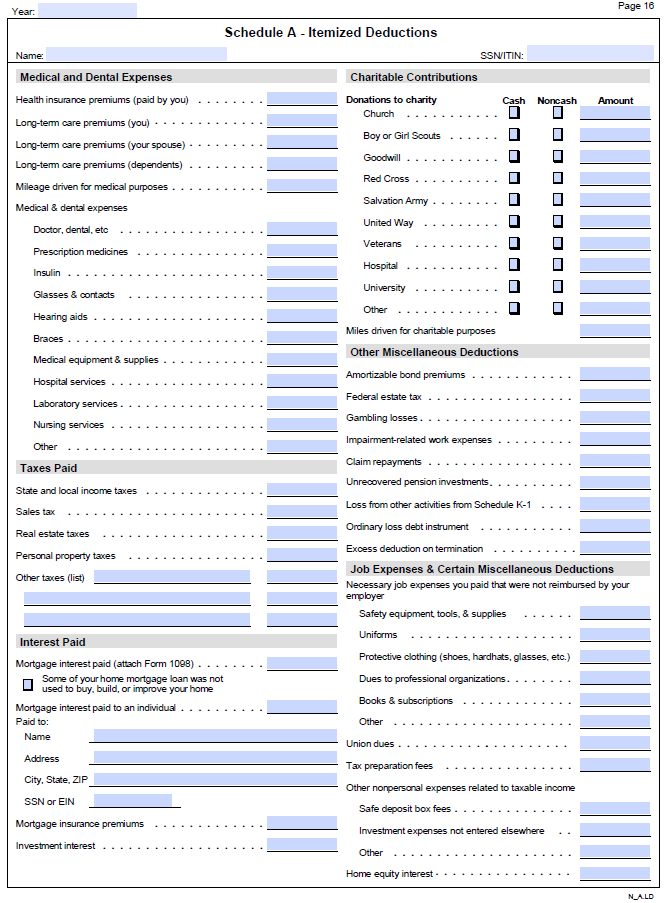

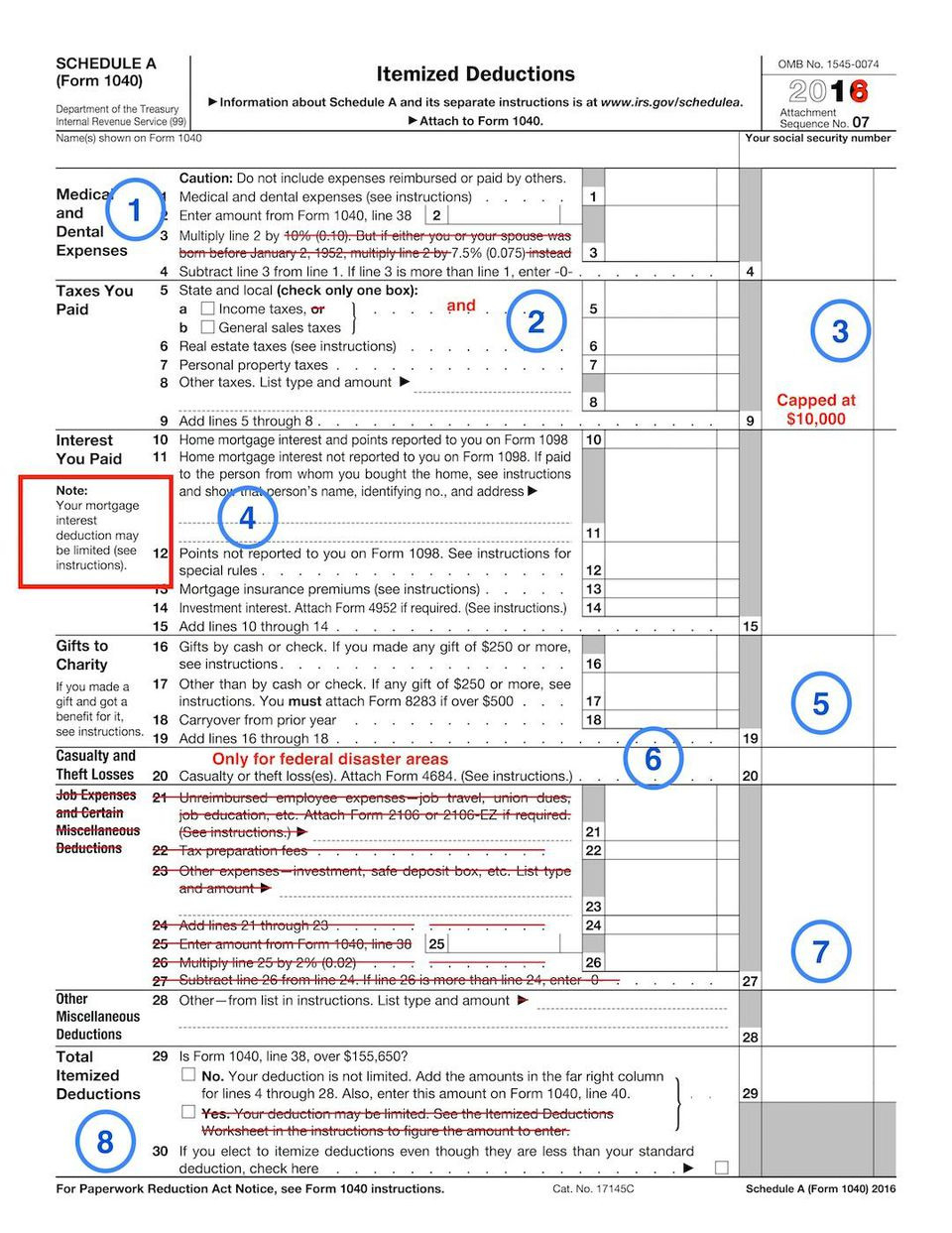

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Itemized deductions amount state and local taxes (income and property taxes) $10,000 home mortgage interest $6,000 medical expenses (over 7.5% of agi). Itemized deductions are an alternative to the standard tax deduction and can help you reduce your total federal income tax bill.

Source: materialmagicbaier.z19.web.core.windows.net

Source: materialmagicbaier.z19.web.core.windows.net

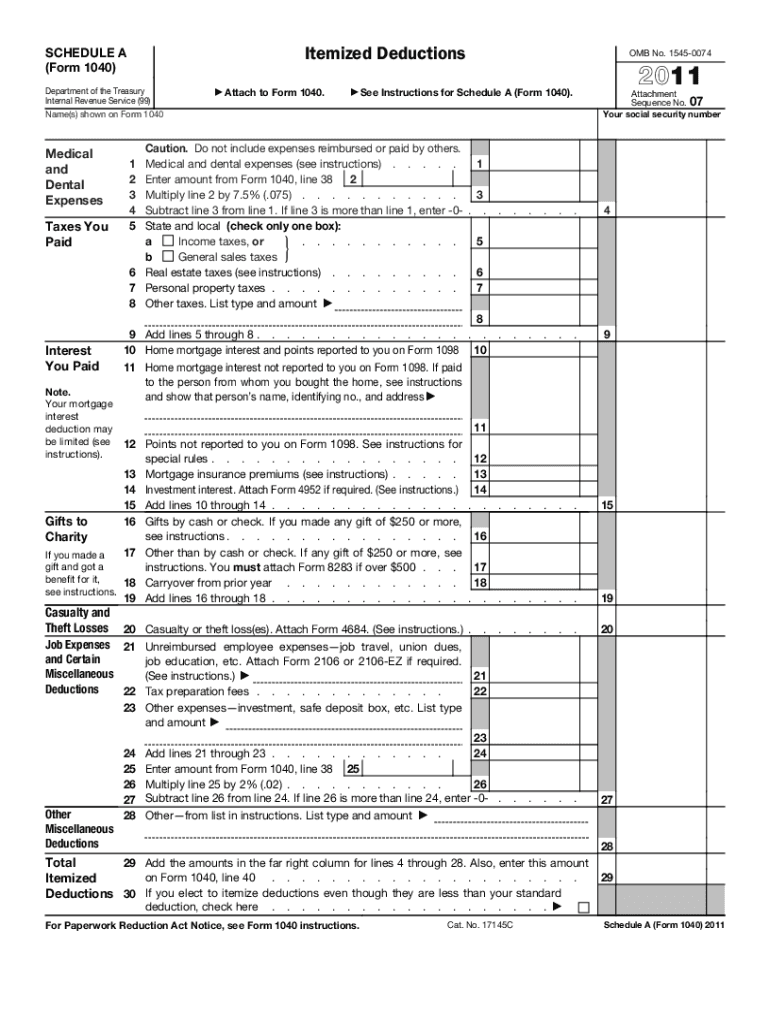

Itemized Deductions Worksheet Ca 540, If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to deduct the medical and dental. Itemized deductions are specific expenses you can subtract from your adjusted gross income.

Source: layneyzpeggy.pages.dev

Source: layneyzpeggy.pages.dev

2024 Itemized Deductions List Leah Sharon, Itemized deductions are an alternative to the standard tax deduction and can help you reduce your total federal income tax bill. Itemized deductions help taxpayers lower their annual income tax bill.

Source: yolanthewquinn.pages.dev

Source: yolanthewquinn.pages.dev

List Of Itemized Deductions 2024 Form Donia Garland, The standard deduction or itemized deductions. Itemized deductions amount state and local taxes (income and property taxes) $10,000 home mortgage interest $6,000 medical expenses (over 7.5% of agi).

Source: maryrosezebony.pages.dev

Source: maryrosezebony.pages.dev

Schedule A 2024 Only 4 Itemized Deductions Left Nhl Playoffs 2024, Tax credits and deductions for individuals. Taxpayers who choose to itemize deductions may do so by filing schedule a (form 1040), itemized deductions.

Source: itep.org

Source: itep.org

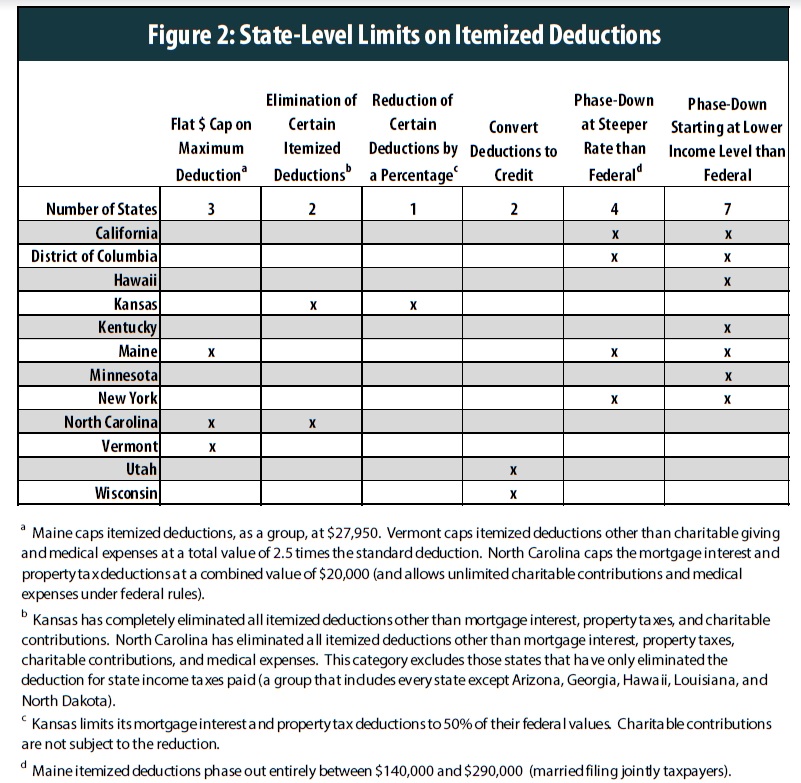

State Treatment of Itemized Deductions ITEP, Personal property taxes are different from property taxes. A taxpayer must choose either the itemized or standard deduction.

Source: db-excel.com

Source: db-excel.com

What Your Itemized Deductions On Schedule A Will Look Like —, Itemized deductions include a range of expenses that are only deductible when you choose to itemize. Itemized deductions that taxpayers may.

Source: byveera.blogspot.com

Source: byveera.blogspot.com

Itemized Deductions Form 1040 Schedule A Free Download Worksheet, $13,850 for married, filing separately; $20,800 for head of household;

Source: www.youtube.com

Source: www.youtube.com

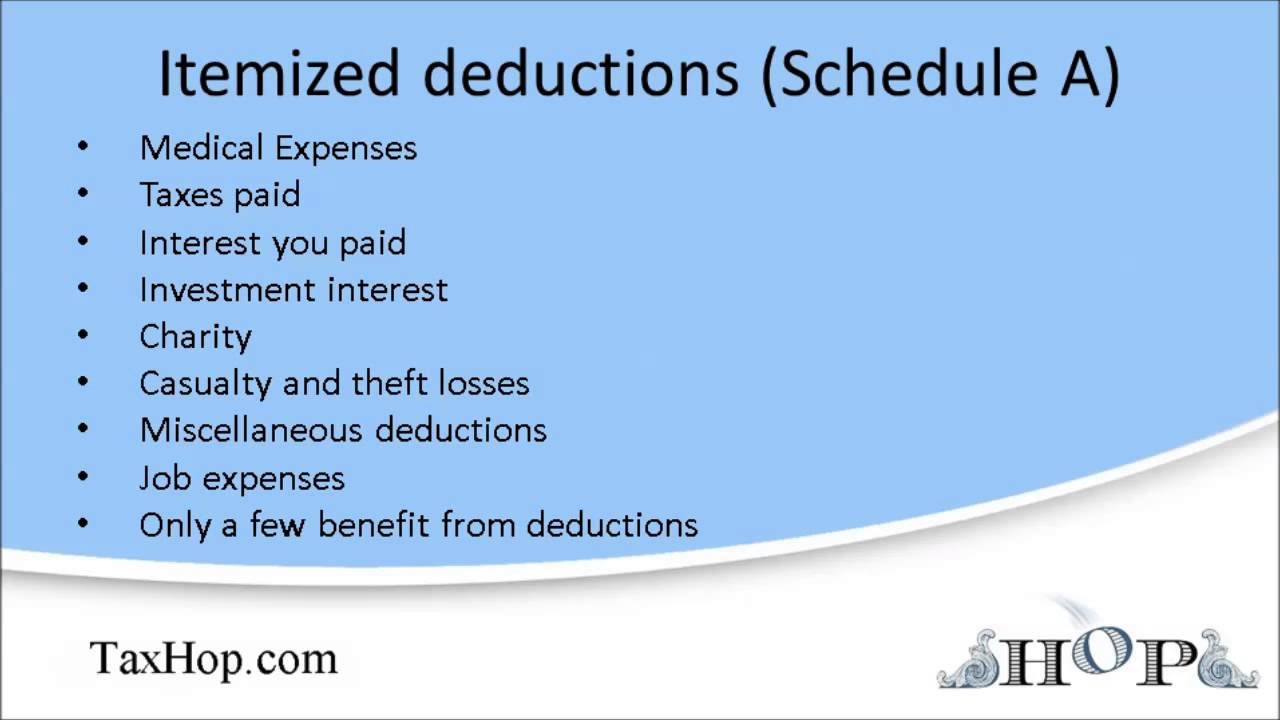

Itemized Deduction vs. Standard Deduction, Explained. YouTube, Itemized deductions are specific expenses you can subtract from your adjusted gross income. Itemizing (and thus, filing schedule a) will usually save you money if the sum of your itemized deductions is greater than the.

Source: classschoolscherer.z19.web.core.windows.net

Source: classschoolscherer.z19.web.core.windows.net

List Of Items For Itemized Deductions, That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction. An itemized deduction is an expense that can be subtracted from your adjusted gross income (agi) to reduce your taxable income and lower the amount of taxes you owe.

For 2023 Tax Returns (Those Filed In.

A taxpayer must choose either the itemized or standard deduction.

Homeowners Can Deduct Their Property Taxes As An Itemized Deduction.

Deductions reduce the amount of the income you owe taxes on, thus.